WE OFFER

Are you ready? | Have you future proofed your tomorrow?

If you are born in the mid-2000s you will live beyond 100

The 100-Year Life is a wake-up call that describes what to expect and considers the choices and options that we all will face.

(Lynda Gratton and Andrew Scott – The 100-year life)

The 100-Year Life is the challenges and the intelligent choices everyone of any age must make to turn greater life expectancy into a gift and not a curse.

Whilst life expectancy has increased for decades, society continues to structure lives in the same way as the past; we learn, we work, we retire.

The way forward is a multistage life, not determined by our actual age; rather by the phase of life we are experiencing.

Gone is the traditional retirement age of sixty-five; now with healthy choices and medical advances we will outlive our parents by 10 years, and our children will outlive us by 20 years!

Longevity is no longer about getting older; it is really about getting younger!

The 100-year life makes it imperative to future proof tomorrow as our finances must stretch not for the traditional 10-15 years after retirement, but rather 15-30 years!

This is a call to action for individuals; people like you and me, that a 100-year life can be a wonderful and inspiring one. If you have planned? Are prepared? Have you future proofed tomorrow, beginning today?

Steps to FUTURE-proof your tomorrow… the goal being Personal and Financial FREEDOM

1. Protect self and family from the financial consequences …

Death of the breadwinner(s) … Severe or Critical illnesses … Inability to work ….In your business … Loss of key people, partners … Planning an exit strategy from the business … Use the business to provide for retirement planning.

2. Estate and Tax Planning …

Take extra care if you have assets in multiple countries

Wills, take steps to minimise inheritance taxes, ensure heirs have access to cash

Selecting executors and guardians wisely, living & testamentary trusts

3. Savings & Investments to meet certain goals …

Invest monthly and or with lump sums

To educate children

Invest in property

For that special holiday

Create savings and wealth in hard currency

4. Retirement planning for a 100-year life …

Traditionally retirement was sixty-five. No longer as you will live much much longer. The question is, “Will you be able to retain your quality of life? ”

Healthy living, better lifestyle choices and medical advances means we will outlive our parents by 10 years, and our children will outlive us by 20 years!

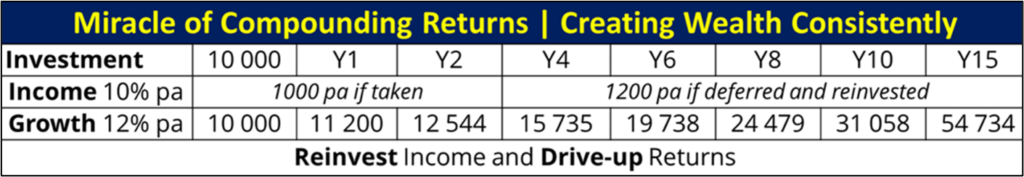

The 100-year life demands working longer. How much longer depends on your wealth and the passive income it provides (Money at work while you are doing your favourite “things.”) It is not safe and is risky to keep money in a bank. Inflation is mostly higher than bank interest rates. If you do not earn more than inflation on your investments you are going backwards, getting poorer. Wealth must grow above inflation! Look at the table and the years it takes to double wealth.

One job, One career, One home, One retirement location … is a disappearing way of life!

Diversification in investments is key …

Africa represents 3%, South Africa 0,6% of global GDP; The USA 13,6% The EU 15,4% The UK 2,1% No one country or asset class is the complete investment solution.

Protection of wealth …

Cost effective solutions exist to protect wealth from creditors, partnerships that have gone bad, governments and tax authorities that are overzealous from estate, probate costs, executors’ fees, and inheritance taxes

START … now, BE in control!

Fixed Income Investments | Returns in £ : $ : € & ZAR

Fixed Income Investments?

Investing in the 21st Century

Traditional investment strategies focus on Cash, Money Market Funds, Bonds and Equities which includes Indexes/ETFs/Funds. And these traditional assets have disappointed in the last decade.

Investors seeking value and returns have turned to what is referred as alternatives, the “5th Asset Class” which includes collectibles like art, exotic cars, gold coins, renewables, private equity, and private lending.

Quality Group specialises in unlocking secure and above average returns that can be found in private equity and private lending situations that display the following characteristics:

○ returns exceed inflation

○ beat bank interest rates

○ are disconnected from markets

○ with no or little volatility

○ with returns that can be relied on

These investments are collectively known as Fixed Income

The fixed income market is king!

Fixed Income dominates equity markets and is more than three times the size of global equity markets. Why? Because it appeals to the investing community who require steady returns. Like Pension funds and investors seeking stability.

Fixed Income Investments

provide

○ Passive Income

○ Growth (Income is reinvested)

Fixed Income is steady and consistent. If income is not required immediately it can be reinvested, driving up returns. Quality solutions have built in protection for investors. Below find Quality Group unique Fixed Income Solutions.

Quality Fixed Income Solutions ticks the boxes for investors who appreciate no volatility on the journey to financial freedom and retaining Quality of Life. Quality believes …

How we invest … is how we live tomorrow

Future proof tomorrow, Starting today!

For building wealth

○ to fund education goals

○ deposit for a home

○ building retirement wealth

○ solid financial freedom

For passive income

○ steady and consistent

○ preserving purchasing power

○ before THE GOLDEN YEARS

○ after THE GOLDEN YEARS

Arbitrage by Crypto | Ultra-low risk investment

Arbitrage is a risk-free investment that profits from inefficiencies in the market.

What is Arbitrage?

Arbitrage is the practice of buying and selling an asset in order to profit from a difference in price. Arbitrage can exist because of inefficiencies in the market. The secret to successful arbitrage is knowing in advance what the asset can be purchased for and what it can be sold for! This becomes a risk-free way to earn a profit.

This concept can be used to describe any asset being bought and sold for a profit; it refers to apples, oil, gold, stocks, bonds, currencies, and other financial instruments including crypto. Watch the short video on arbitrage.

What is Crypto arbitrage?

The concept of crypto arbitrage is to buy crypto while simultaneously selling it at a higher price, profiting from the difference in price. Since the transactions occur at the same time, there is no holding period; this is a risk-free profit strategy.

Why is Crypto ideally suited to arbitrage?

The price of cryptos are quoted on electronic exchanges and electronic transactions occur in milliseconds and can be recorded on the blockchain ledger.

What is Blockchain in simple words?

Blockchain defined: Blockchain is a shared, immutable ledger (Cannot be changed) that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible (a house, car, cash, land) or intangible (intellectual property, patents, copyrights, branding) This includes arbitrage by Crypto.

With crypto transactions, information is decentralized, meaning no single person or group has control; rather, all users collectively retain control. Decentralized blockchains are immutable, which means that the data entered is irreversible.

Why is Arbitrage by Crypto an ultra-low risk investment? With crypto arbitrage, it is possible to lock in the buy and sell trade prices, then execute the trade simultaneously; this is risk free arbitrage. Unlike other assets that are bought and sold for profit, the huge advantage of crypto is the ability to lock in the buy and sell price n advance. If the trade is not suitable it is not executed.

Trades are only executed if the result is positive profit for the investor

Golden VISA Programs | For Residency-For Citizenship-For Business

“ … Make the most of life with a life without borders.

Golden Visa can help you start living your best life …”

MULTI-Residency and Citizenship

There are various programs that meet business and family needs. In exchange for an investment in the economy of your chosen country, investors are granted residency and/or citizenship.

For Business Relocating or setting up a new business or branch or head office in a different country is gaining more and more traction. Reasons are many, diverse and compelling … like trading into new markets, tax incentives, or local business conditions

For Families Global multi residency & citizenship opportunities is a growing trend as individuals and families seek to meet varying needs and goals.

100-Year Life The 100-Year Life brings challenges and the intelligent choices everyone of any age must make to turn longer life expectancy into a gift and not a curse. Whilst life expectancy has increased for decades, society continues to structure lives in the same way as the past; we learn, we work, we retire.

Multistage Life The way forward is a multistage life, not determined by our actual age; rather by the phase of life we are experiencing. Influenced by the local political and economic environment, with current and future choices determining quality of life.

MULTI-Residency and Citizenship

Many reasons … Many benefits

Travel Visa Free

Business & Pleasure

Business & Career Opportunities

A Different Future

Tax Incentives

Personal & Business

First world

Healthcare & Education

New Beginnings

Holiday Home

A safe haven investment

Plan B “In the back pocket”

Investment & Currency Hedge

Property Rentals

Quality Group is well versed on Residency & Citizenship programs and Business relocations We and our partners provide a full service from start to finish, including property investment and applications for Golden VISA for residency and citizenship as well incorporation of companies, legal, trust and accounting services.

Allow us to understand your requirements, and Quality Group will put forward recommendations.

Inspection Trips

For Cyprus, Greece and Mauritius check out our inspection trips

For more information (Click option below)

Protection in USD | Self – Family – Business

Global Benefits in USD

Severe illness Death.

The BEST medical care can be obtained, if one can afford it, as it is priced in US Dollars. If one suffers a dreaded disease or severe illness the costs are normally calculated in hard currency and in soft currency countries it a very real problem.

No matter where you are … today or tomorrow

Disability | Death.

A disability is any condition of the body or mind (impairment) that makes it more difficult for the person with the condition to do certain activities. This can be temporary or permanent. Money is needed for resources to help the person recuperate or adjust to their impaired lifestyle.

Access the best medical care

Death

The financial impact caused by death is enormous. From providing cash for “food and shelter” to relocation, paying off debts, education of children, to lifestyle consequences! Two “breadwinners” becomes one or one “breadwinner” becomes none!

Tax efficient Payouts

The monthly bills don’t change much. And then there is taxes and fees to wind up an estate. A family might be asset rich but cash poor. Result assets are sold off at discounted prices to pay debts, executors fees and inheritance taxes.

Benefits | Life-Disability-Severe Illness-Cash

Protect in USD

Individuals, Families, Business

Death, Disability, Illness/dreaded diseases

Business Partnership and Keyman

Dollar life pays into any nominated bank account in the world in US Dollars. And incurs no executors-fees, no estate duty or inheritance taxes!

Business owners and Beneficiaries get paid immediately as the US Dollar pay-out bypasses the deceased estate, is not frozen, there is no probate, and no death or inheritance taxes!

Monthly Savings Investment

Monthly savings investment into global funds

Fund from RSA or from anywhere in the world

USD tax free payouts

For Retirement, Childrens International Education, Travel …

This is an example of one of the available funds

Student Accommodation | Rental Income in hard currency

” “

Student Accommodation Assured Returns

Student Accommodation

The closure of campuses during the height of the COVID pandemic meant less demand for student accommodation, but that has all changed, as students desire the campus life and experience.

Demand is outstripping supply, which is an opportunity for investors.

Golden VISA Residency

Investors can combine investment in student accommodation with Golden VISA, a path to investment, residency, and citizenship.

A way forward for parents and their children’s career opportunities